T-61.271

Information visualization

Visualization

project 27

Misleading

visualizations

13

January 2003

Henrik

Ingo

47010e

hingo@cc.hut.fi

Abstract

The Post-Enron world with it's tough requirements on reliable

financial reports has left US accountants and CEOs without choice.

They will now have to tell us the truth and nothing but the truth

about their companies financial status. Or do they?

While the art of creative accounting may have come to an end when it

comes to the actual numbers in the the book, there are still other

ways in which a financial report could mislead it's reader into

believing that everything is going great.

This paper suggests various ways to make "better than reality"

charts, while at the same time preserving correctness with the

underlying statistics. Each technique is briefly evaluated in terms

of a lie factor and whether

or not it fulfils the requirement of embellishing the truth while at

the same time not getting caught.

Some real world examples are also evaluated in the same way.

This

essay is hereby released into the Public Domain. To view a copy of

the public domain dedication, visit

http://creativecommons.org/licenses/publicdomain or send a letter to

Creative Commons, 559 Nathan Abbott Way, Stanford, California 94305,

USA.

Some

images used as illustrations are part of the CorelDraw 8 Clipart

gallery and yet others have been copied as citations from

publications where they first appeared. While it's ok to copy and

distribute them as part of this essay or any future modified version

of it, they are not public domain in themselves.

This

essay is available on the web at

http://www.cafe-seed.net/~hingo/kirjoituksia/misleadingvisualizations.html

1.

Introduction 3

2.

Basic concepts and tools 4

The Lie Factor 4

The Psychological Lie Factor 5

The Thumbs rating 5

3.

Manipulating the axes 6

Pick your own interval 6

De-emphasize with a large interval and

stretching 7

When to use a negative scale 8

Picking the most suitable scale 9

Real World example: Yahoo!'s daily

stock quotes 11

4.

Artistry 12

The magnifying glass 13

5.

Confusing dimensions 13

Is this 1d or 2d? 13

Or is it 3d? 14

A deceitful perspective 15

A background with perspective 17

6.

Distractions 17

A suitable placement for the labels 18

7.

Simply hide the ugly details 19

No context 19

Or too much 20

Real World Example: Oikotie ad in

Helsingin Sanomat 21

8.

Optical illusions 22

Grayscale tricks 22

Texture variations 24

9.

Summary 25

1. Introduction

The past year we have seen some surprising turns in the world

economy. After a couple of cheerful years of so called New

Economy, stockbrokers were

issuing warnings of an expected downturn. And down we went.

But what happened then? Enron. And with

them almost overnight one of the worlds biggest auditing firms

Andersen simply ceased to exist. Enron had been supporting the

Republicans. And when I say supporting, I don't mean that the

employees used to cheer for the politicians during congress meetings

- no, you know what kind of supporting I mean. But when shortly after

that the Democratic Party backing WorldCom announced that they had

accounted for 7 billion of dollars that didn't have any counterpart

in Real World dollars, even Mr W got a bit upset. "From now on

any dot-com that funds the Democrats will have to report their

earnings truthfully, or else..." he declared.

So with the threath of facing 20

years of jail - merciful as he is, W didn't, at least yet, threaten

with the chair he has back home in Texas - accountants all over the

USA are now faced with the dull prospects of only accounting for

money that actually exists, as we used to do back in the good Old

Economy days. But that of

course poses some new challenges. "How are we going to make the

investors like us, if we have to tell them the truth?" some

might ask. One might even argue that if this kind of creative

accounting had not been allowed during the last years, we might never

have seen any of the New Economy that, after all, was a happy time

wasn't it?

But maybe all is not lost, my friends. Even if the actual numbers

will now have to be truthful, there still are some tricks a dot-com

might turn to. This paper discusses the art of making charts that

lie, while being technically correct. Accountants all over the world

will be delighted to find, that it's possible to make a financial

report that at the same time is 100% correct but also looks good. It

is kind of like painting pretty pictures next to a horrible story.

The logic of using such misleading graphics in forthcoming financial

reports would therefore be:

When given a choice, most readers will rather look at the

colorful graphics of a report than the actual numbers presented in a

dull table.

It is possible to make such graphics look much better than

the underlying statistics, while at the same time preserving their

integrity - or shall we say at least technical correctness.

In the following pages we will learn some techniques, to make such

charts. Each technique is presented separately, as a kind of building

block. It's left to the reader to combine suitable techniques in

order to achieve the best possible results for his financial report.

After presenting the various techniques of deception, some real world

examples are also investigated.

This paper was written as part

of a course in Information visualization, at Helsinki University of

Technology. Most ideas are drawn from or have at least been inspired

by the two coursebooks"The Visual display of quantitative

information"[2] by Edward Tufte and "Information

visualization: perception for design"[3] by Colin Ware. Most

basic tricks have their roots in Tufte while the more advanced tricks

that play with the shortcomings in the psychology of our vision are

from Ware.

It is my humble wish that it may help US accountants to save the

world economy.

Question:

(totally unrelated to the topic of the paper)

If the financial boost during the so called New Economy was only a

boost on paper - that is, none of the fuzz actually existed as real

money - is it then also true, that the current depression is also

only a depression on paper, since there never really was any money to

be lost?

2. Basic concepts and tools

Before we start looking into the various techniques, let's start

with introducing a couple of concepts, that will be used in

evaluating the techniques.

The Lie Factor

The lie factor is a concept that is introduced in Edward

Tuftes book "The Visual display of quantitative information"[2].

The idea of the lie factor is to express in numbers, how much a

graphic deviates from the actual data it should represent. The

formula for calculating the lie factor is thus:

(1)

(1)

For instance, if we have a simple table with two numbers:

The basic bar chart would then become:

Since this is an accurate representation of the data,

the lie factor equals one. On the other hand, the artist in charge of

making charts might for some weird reason decide to "emphasize"

the second bar in the chart:

Now the second bar is much taller than the first one,

even though both claim to represent the value 100. If we assume that

the size of the first bar is correct we can now calculate the lie

factor for year 2002:

(2)

(2)

A good rule of thumb to remember: Truthful charts

always have a lie factor of one, whereas any other lie factor

indicates a misrepresentation.

The Psychological Lie Factor

As we shall see, it is quite feasible to make charts that have a

lie factor of one, but still manage to fool the eye into seeing

something that wasn't in the data. These charts are technically

correct but they lie anyway. In these cases we will talk about a

psychological lie factor, which would be defined as something

like:

(3)

(3)

The "looks like" part will often only be a

subjective estimate, but nevertheless this will be a useful concept

in evaluating how much a graphic manages to fool the viewer.

The Thumbs rating

Finally we will rate each technique with a thumbs-up or

thumbs-down figure, possibly with handcuffs added.

Table

2: The Thumbs rating

This rating will characterize how the technique relates to the two

questions:

In terms of the lie factors, the artist will typically avoid

handcuffs and jail, if the lie factor is one. The thumbs up rating on

the other hand, will be given to graphics where either the lie factor

or the psychological lie factor is not equal to one.

Another funny side note:

It is perhaps worth noting, that what we normally would regard as a

good graphic, would here receive a thumbs down rating, because of the

fact that it represents the data as truthfully as possible. In this

essay, that is not a wanted feature.

On the other hand, such a graphic would avoid the handcuffs, so

honesty is not that bad after all.

3. Manipulating the axes

The first set of techniques, is based on manipulating the axes to

better suit our needs. Let's go straight to it.

Pick your own interval

To demonstrate these techniques, let's play with some figures from

our favourite stockmarket company Nokia.

In an ordinary graphic, these numbers become two equally heigh

bars:

The bars look similar. Even though Nokia did quite well,

increasing it's sales by 3%, it isn't obvius from the chart. It's

probably okay if we emphasize that growth just a little:

Who says that the scale has to start from zero? Nothing important

happens before 30 billion euros anyway. With focusing on the range 30

000 - 31 200 we have made year 2001 stand out as a major year of

growth, instead of being practically equal to it's predecessor, as

the first chart might have led us to think.

So

what about the lie factors? Technically there is nothing wrong in

what we have done. The numbers on the Y-axis are there, and the bars

are exactly the height of the values they are supposed to represent.

The chart comes out with a lie factor of one! When comparing the two

charts above, it is however obvious, that the second one is more

positive than the first one. Even though we can clearly see the

correct numbers to the left, our eyes tell us that the bar to the

right is 3,16 times higher than it's left companion. The

psychological lie factor will therefore be 3,16/0,03 = 105!

So

what about the lie factors? Technically there is nothing wrong in

what we have done. The numbers on the Y-axis are there, and the bars

are exactly the height of the values they are supposed to represent.

The chart comes out with a lie factor of one! When comparing the two

charts above, it is however obvious, that the second one is more

positive than the first one. Even though we can clearly see the

correct numbers to the left, our eyes tell us that the bar to the

right is 3,16 times higher than it's left companion. The

psychological lie factor will therefore be 3,16/0,03 = 105!

The graph will therefore be awarded a definitive thumps-up and no

handcuffs! A simple but powerful technique, that is in fact often

used in advertising.

De-emphasize with a large interval and stretching

The previous technique has one major drawback. It can only be used

to over-emphasize data that actually exist. If sales had gone down

during 2001, we could not have saved ourselves using this technique.

The same technique can however be reversed. We can choose an overly

broad interval. That will not turn profits into losses, but it will

de-emphasize the downward trend into something that seems to be very

flat. This could have been useful in reporting Nokias net profits for

the same time period:

Table

4: Net profits for Nokia 2000-2001

|

|

2000 (EURm)

|

2001 (EURm)

|

Change %

|

|

Net profit

|

3938

|

2200

|

-44

|

A decline by almost half will not look good:

But with a different scale it's not that bad:

To hide the decline we have streched the x-axis which

made the bars thicker and thus helps de-emphasize their height.

But hey, wait a minute! Why do those bars start from a

negative 4000? There is really no good reason, nor even a mediocre

excuse. The only reason is, that it was really hard to get those bars

equally high. And even if I cheated a little, the right one still

looks shorter than the left one.

So

even if the chart is still technically correct, the cheating is too

obvious and what's even worse, the decline in profits is still

visible. This technique might be handy in some cases, but to cover up

a decline by almost 50% is too much to ask. We are forced to give a

negative verdict: thumbs down and caught for cheating!

So

even if the chart is still technically correct, the cheating is too

obvious and what's even worse, the decline in profits is still

visible. This technique might be handy in some cases, but to cover up

a decline by almost 50% is too much to ask. We are forced to give a

negative verdict: thumbs down and caught for cheating!

When to use a negative scale

There are situations, when negative numbers might be excused.

Suppose Nokias profits continue to decline, and turn into losses in

2002. (At the moment of writing this doesn't seem very likely, but

let's imagine they do.) Let's say that for 2002, Nokia would report a

loss off 500 million euros:

Declining profits is bad enough, but if a company starts to lose

money it's even worse. The worst thing to do is to start emphasizing

that with red color! This might be a situation, where it is tempting

to drop the x-axis downward, so that all bars at least point up:

We

won't go into the discussion about the lie factors for this graph

(I'm trying to avoid the need to introduce the concept of a negative

lie factor), but it is obvious that it makes a difference whether

something points up or down. Whether we are still on the safe side

legally is a tough call. Now when we actually have negative values in

our data, it might be okay to have a negative axis. The judge might

let it pass, but I'll leave the handcuffs on just to be safe.

We

won't go into the discussion about the lie factors for this graph

(I'm trying to avoid the need to introduce the concept of a negative

lie factor), but it is obvious that it makes a difference whether

something points up or down. Whether we are still on the safe side

legally is a tough call. Now when we actually have negative values in

our data, it might be okay to have a negative axis. The judge might

let it pass, but I'll leave the handcuffs on just to be safe.

Picking the most suitable scale

Above we have used techniques where we pick a suitable begin and

endpoint for our axes and also stretch them according to our needs.

One last thing to consider, is the scale itself. If you've paid

attention in a statistics class, or even explored your spreadsheet

application (Excel), you might have heard about something called a

logarithmic scale. A logarithmic scale is typically used to present

data, that grows or otherwise changes exponentially. It has an effect

of emphasizing the variations in small values (from 1 to 10) and and

de-emphasizing the variations of larger values (100 to 1000).

Consider the development of the Nokia stock over the past 5 years:

The curve seems to be rather smooth until the end of 1999 when it

suddenly starts rising. During 2000 the ups and downs are extreme,

but towards 2002 the curve smoothens again. The New Economy bubble is

evident. Or is it...

What bubble? Sure the stocks seem to rise during 1998, but other

than that this curve seems very smooth. What's happening here?

The former chart shows the development of the literal value of the

stock. The latter chart on the other hand, shows the relative

development. Let's say that Nokia drops 10% during one day and see

what it looks like on the first graph. If the drop happens in January

1998, it's likely to go almost unnoticed in the graph, since the

change is less than 0,5$. But if it happens during January 2001 it

will certainly be noticed, because now it's more than one interval on

the y-axis.

On the latter chart both of these 10%

drops, as well as any other 10% change, would be of exactly the same

size. That's because the logaritmic size shows relative changes,

while the linear scale shows absolute changes.

So, what does all of this mean? The

former chart is what we recognise from the economic news and press.

But in times like these, why not use the second chart? "I

don't know about you guys, but we here at Nokia have certainly not

seen any bubbles burst. Our curve is as smooth as ever!"

So

what about the handcuffs? Again we are not doing anything wrong,

altough you could argue that the log10 scale means a psychological

lie factor of 10. In any case the scientists do it all the time, so

it must not only be right, it's probably also intelligent and cool!

The only dishonesty is simply that people are used to seeing the

first chart. Thumps up and no handcuffs!

So

what about the handcuffs? Again we are not doing anything wrong,

altough you could argue that the log10 scale means a psychological

lie factor of 10. In any case the scientists do it all the time, so

it must not only be right, it's probably also intelligent and cool!

The only dishonesty is simply that people are used to seeing the

first chart. Thumps up and no handcuffs!

Real World example: Yahoo!'s daily stock quotes

The problem with picking a suitable scale and interval for the

axis, is that you always have to pick something. What is right and

what is cheating is not always easy to say.

Take this graph from Yahoo as an example. It's a curve of one days

exchange rates for Nokia:

At first sight it looks like Nokia had a rough day. But then you

look at the scale of the y-axis and realise that all variation was

within 35 cents and what's even more, at the end of the day we are

pretty much back to the same level where we started in the morning. I

don't know much about the stock market and it could be that 35 cents

is very significant but at least it's still much less than the

interval Nokia had the previous day, which was almost a dollar:

Yet the curves look very much alike at first sight.

What's happening here? Yahoo scales each graph, so that only

what's significant will show. That is a valid excuse, it would not

make much sense to have a constant scale for all days and different

companies, since some curves would surely not fit on the screen at

times of turmoil while others would look like a dead straight line.

Scaling into what's significant is the best option if we want to

maximize the amount of information in the graph.

But

there is still a pitfall. This approach guarantees that all charts

will look like there was a storm at the stock exchange, even when the

curve is in fact very flat. A thumbs up to Yahoo for making sure that

every day on the stock market looks exciting. And no handcuffs for

the (very much so) valid excuse.

But

there is still a pitfall. This approach guarantees that all charts

will look like there was a storm at the stock exchange, even when the

curve is in fact very flat. A thumbs up to Yahoo for making sure that

every day on the stock market looks exciting. And no handcuffs for

the (very much so) valid excuse.

4. Artistry

One obvious way to achieve our goal of beautifying the actual

data, is straigthforward: Simply draw a picture that looks the way

you want it. This is the category that Tufte calls "the Pravda

school".

I think the Sovjet artist definately deserves a thumbs up!

The graphics in this section should be accompanied with the

subtitle "all characters and events in this movie are fictious,

and any resemblance to actual persons or events is purely random".

Obviously, all charts in this chapter will have a thumbs rating with

handcuffs on. That follows directly from the definition.

The magnifying glass

A typical thing to do, which at first thought sounds like

something perfectly normal, is to emphasize this years figures. Let's

look at our second most favorite stock company: Sonera.

Talk about technology bubble! Less than a third is left from the

profits of 2000. But don't worry, zooming in on 2001, it doesn't look

all that bad after all:

This

is the wet dream of Enron accountants! Just stretch the bar in both

directions until it's big enough. The slope in the bottom line

provides a hint for the viewer, that we have broken the scale at this

point and moved in for "a closer look". This is a standard

way of drawing in perspective, so the reader might even think this is

ok. But it's not. The lie factor for this graph is

This

is the wet dream of Enron accountants! Just stretch the bar in both

directions until it's big enough. The slope in the bottom line

provides a hint for the viewer, that we have broken the scale at this

point and moved in for "a closer look". This is a standard

way of drawing in perspective, so the reader might even think this is

ok. But it's not. The lie factor for this graph is

(2,75 cm / 409

EURm) / (2,95 cm / 1506 EURm) = 3,4

and the stretching of the

x-axis and the brighter red add some more for a psychological lie

factor. Click click, on with the handcuffs.

The artistry category could be expanded by many more masterpieces.

In fact once the artist gets going, the charts will be much more

decorative. But the idea will always be the same as in this basic bar

chart.

5. Confusing dimensions

One type of artistry that deserves to be given it's own category,

is the play with dimensions.

Is this 1d or 2d?

What about exchanging the dull bars with something more

interesting? Like a bag of money, for instance. Here are the same

results from Sonera again:

It's the same bar chart but fancier. What we are doing here is

playing with the viewers mind. How much money does the big bag

represent? It's hard to tell really. The bag looks tall, but on the

other hand it looks slim. A slim year 2000? What if we make both

height and width dependent on the profit:

Whoa! That year 2000 really was something after all! Note that the

bags are exactly as tall as in the first chart, but the effect is

rather different this time.

Let's try some other variants. If we really want to have

2-dimensional moneybags, it would be more correct if the area

of each bag represents the value, rather than the radius:

Suddenly year 2000 doesn't look that different from the others.

Or is it 3d?

But since we are dealing with moneybags, shouldn't the size of the

bag reflect the amount of money that's in it? Or if we put it in the

language of geometry, shouldn't the value be relative to the volume

of the bag? Let's try that too:

As you might have guessed, the bag with 1506 million euros shrinks

even further. That we have added a 3-dimensional lighting effect

doesn't help, the 1506 million euros look awfully small.

Looking at the above charts, we can conclude that playing with

dimensions greatly affects what the viewer sees in a graphic.

So what about the lie factors? The thing is, all charts are

correct in their own way. The problem is to know from which

dimensions the variables should be read. So it's really up to the

viewer. To make an extreme example, if we interpret the bags in the

second chart as true 3-dimensional bags, we get a lie factor of

...which must be some kind of a record!

But as a more general summary, we can conclude that

The first chart with moneybags is the one most like bar

charts. It confuses the viewer, but whether it emphasizes or

de-emphasizes things isn't immediately clear and may depend on the

data and type of image used. To me it looks like this chart is

emphasizing the loads of money made in 2000, but that could be

subjective.

The second chart is obviously an exaggeration. In fact,

because we have used the same variable in two dimensions, it's

almost knocking on the border of being illegal, but we'll judge it

still being on the safe side.

Using true 2d and especially 3d images, is a great way of

smoothening.Year 2000 is greatly de-emphasized.

Personally, I find the true 2d chart to be the most intuitive

one, and thus most truthful, but the first chart is probably the one

to be generally acceptable, because it is basically a normal bar

chart with pictures. The first chart is also most likely to be seen

in artistic charts, because both Excel and OpenOffice contain a

feature to use images as bars.

In

short, a great package of tools for both growing and shrinking things

as needed. And all of it completely on the legal side!

In

short, a great package of tools for both growing and shrinking things

as needed. And all of it completely on the legal side!

A deceitful perspective

While we are at the subject of 3d imagery, let's delve into two

other useful techniques in the same category. Look at the same Sonera

bars once more, now with a 3d effect courtesy of OpenOffice Calc:

Those OpenOffice people have done a nice job with their 3d

effects. It's even possible to rotate the chart so that you get

another perspective. Here is another chart that is almost like the

one above:

So, what has changed? In the first chart, the perspective is such

that we are looking at the bars from a very low viewpoint. In the

first graph, it is as if we are about the same height as the four low

bars, while the tall bar of year 2000 is way higher than anything

else. In the second version we are looking down on everything, and

also the bar for 2000 looks shorter than us.

And

the judgement for this technique? There is a difference, but one bar

that is three times the height of everything else will stand out no

matter how you twist it. Having seen the moneybag tricks, we are not

impressed with this anymore. In a very tight situation this technique

could be used to give a psychological hint of what should be

considered high and what low. But we will give it a thumbs down. No

lying in this technique though, so there is no harm in using it if

you think it does something for you.

And

the judgement for this technique? There is a difference, but one bar

that is three times the height of everything else will stand out no

matter how you twist it. Having seen the moneybag tricks, we are not

impressed with this anymore. In a very tight situation this technique

could be used to give a psychological hint of what should be

considered high and what low. But we will give it a thumbs down. No

lying in this technique though, so there is no harm in using it if

you think it does something for you.

A background with perspective

For our last trick in this category, let's switch back to the

numbers from Nokia we already had in the beginning. You have already

seen them, but here they are again:

Ok, so the bar for 2001 might still look shorter, but the image in

the background does soften the drop a little bit. The effect comes

from the perspective in the picture. If we interpret the bars as

being part of the landscape, it would seem that the lower bar is

short but close to us, while the upper bar is very big but distant.

If interpreted like that, we could use the boardwalk to estimate that

a psychological lie factor is something between 4 and 5. (The lower

bar would have to be 3 times bigger just to match the upper in

reaching the boardwalk.)

Unfortunately however (for Enrons accountants that is) most people

are not so stupid as to fall for this trick. Most of us simply ignore

the background and interpret the bars correctly, as if the background

was not there at all:

Even

if we couldn't make the shorter bar look taller, the perspective in

the background does bend reality a little, so I think it's worth a

thumbs up.

Even

if we couldn't make the shorter bar look taller, the perspective in

the background does bend reality a little, so I think it's worth a

thumbs up.

I don't know if you noticed, but I had to cheat a little again. In

order for the perspective thing to work at all, I had to make the

upper bar thinner than the lower. Without this adjustment, the trick

simply doesn't work. Even if the length of the bars is still intact,

tampering with the bars in this way is in my opinion going too far.

So we put the handcuffs on again.

6. Distractions

3 dimensional backgrounds is not the only irrelevant thing we can

add to our charts to confuse the reader. The ultimate trick in the

distractions category - only to be used by the truly desperate -

would of course be adding not only a beach but also a bunch of

topless chicks! Or perhaps that would seem too desperate?

A suitable placement for the labels

In any case, I don't have pictures of topless women (sure, and you

couldn't find any on the Internet either...) so I'll show you a

different trick. You have seen these moneybags from Sonera:

The bars/bags are exactly the same, but is there a feeling of a

positive trend in this picture, that wasn't there in the original:

The difference is, in the original the labels that tell

us the actual value of each year are all down at the bottom. In the

modified version above, There is an upward trend - the last value of

409 is actually higher than it's predecessor 1506.

There is no motivation in the data for placing the

labels as I did, but it doesn't feel completely wrong to do it

either. And is the viewer confused? The bags are still there, and

it's obvious that the last bag is much shorter than it's predecessor.

But when reading the values, the reader scans the numbers from left

to right and the eyballs follow the numbers making a slight upward

tilt, giving a subtle feeling of something going upward - a positive

trend.

But it's only a subtle feeling and in fact the reason

why I chose the moneybag chart for this trick is that simple

rectangular bars would have been strong enough to cancel that effect.

The height of a rectangular bar is something very obvious and in

addition it's something we are all very used to interpret. The

moneybags are not as easy to interpret and while the reader is

processing this new type of chart in his mind the eyeballs start

making the upward tilt. In short, an unclear graphic gives more

weight to the effect of placing the labels intentionally wrong.

If you are still not convinced, consider this variant

where the values are placed at the top of each bag:

When

reading the numbers, you have to considerably lift your eyes to reach

the high number of 1506, leaving no doubt that it's way bigger than

the other ones. It's obvious from these three charts that the placing

of labels makes a difference (in fact it's the reason why I chose to

move the labels to the bottom in the 2d/3d experiments). If you want

to emphasize year 2000, use the last version. If you want to create a

feeling of a positive trend, use the first one.

When

reading the numbers, you have to considerably lift your eyes to reach

the high number of 1506, leaving no doubt that it's way bigger than

the other ones. It's obvious from these three charts that the placing

of labels makes a difference (in fact it's the reason why I chose to

move the labels to the bottom in the 2d/3d experiments). If you want

to emphasize year 2000, use the last version. If you want to create a

feeling of a positive trend, use the first one.

No lying involved, the lie factor is an even one. It's

hard to give a numeral estimate on a psychological lie factor, but

it's obvious that the trick works. And another reason to give a

thumbs up: this trick will not upset your mom and dad. Stay clear of

naked women as long as possible!

7. Simply hide the ugly details

In this category we will examine techniques that don't distort

anything. We simply hide the things we don't want to show. And there

is more than one way to do it.

No context

An important property of a chart is to have enough context to be

able to interpret the chart meaningfully. But in this essay we don't

want the viewers to interpret anything meaningfully. Suppose we are

a bit embarrased by the two-thirds decline in profits for Sonera. Why

don't we just cut out the possibility to do any comparison:

Okay, that looks a bit ridiculous, I just wanted to make my point.

Some other data would probably have fitted this technique better. For

instance we could break up the 2001 result into each quarter and then

we would have had four bars to show the same data as above. Our

readers would be satisfied with so many bars to look at and no one

would remember what happened in 2000.

Charts that suit this technique very well are lines and curves of

all kind. Do you remember the boom and bust in the chart of Nokia's

exchange rates over the last 5 years. We already made that bubble

disappear once, but I can assure you that there really was no bubble.

Those mobile companies are a safe and solid bet on the stock market:

Bar

charts with only one bar is going too far, but used with the

appropriate amount of good taste and careful consideration, this

technique will be your friend in many tough situations. And best of

all, it's all 100% true.

Bar

charts with only one bar is going too far, but used with the

appropriate amount of good taste and careful consideration, this

technique will be your friend in many tough situations. And best of

all, it's all 100% true.

Or too much

The other way to go, is to provide more information than anyone

can take down:

Also known as the "They will never know what hit them"

technique. Lucky for us, the turnover has increased even in 2001,

providing for a steadily growing curve on top. Since you can't really

figure what's going on with the other lines, this will give an

overall impression of "something was going up, even if I

couldn't tell what it was".

The spagetti that results from the 9 other lines can also be

interpreted positively: "Lot's of activity in this telecom".

Or in more layman terms: "Those guys at Sonera are really some

hard workers." (Because they have produced so many curves that

just looking at them makes me tired.)

The

only downside with these techniques, is that if you make things too

unreadable, the reader might fall back to reading the actual numbers

in the financial statement again and we were trying to use graphics

to prevent them from doing that.

The

only downside with these techniques, is that if you make things too

unreadable, the reader might fall back to reading the actual numbers

in the financial statement again and we were trying to use graphics

to prevent them from doing that.

Another useful and 100% truthful technique. Just don't overdo it

or you'll lose everything.

Real World Example: Oikotie ad in Helsingin

Sanomat

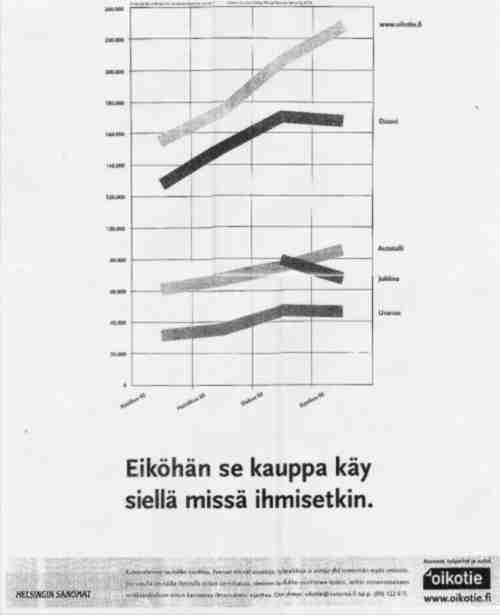

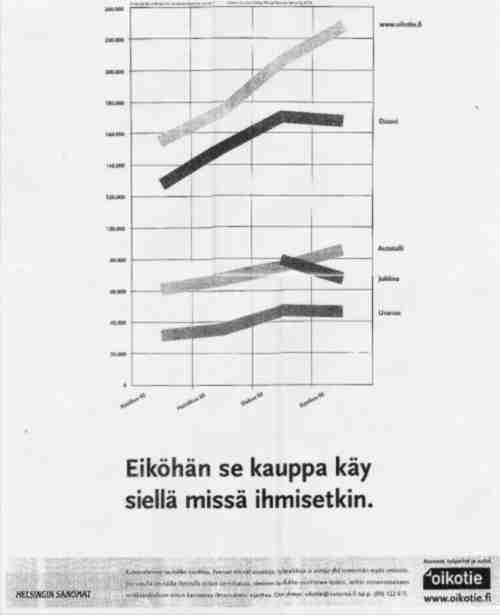

Chart

29: Helsingin Sanomat advertising for it's Oikotie website. Other

websites in the graph are "Etuovi", "Autotalli",

"Jobline", "Uranus".[1]

This full page ad appeared in the daily newspaper Helsingin

Sanomat on 12th November 2002. The graph shows the development of

visitors per month for some Finnish websites, where users can sell or

buy apartments, cars and announce job opportunities. The chart is

intresting to us, because it actually uses several of the techniques

we have just presented.

Firstly the fact that this is a full page ad, provides for some

really phenominal stretching of the Y-axis. Not only is

www.oikotie.fi leading the race, it's doing that with a margin of 7

centimeters to it's closest competitor "Etuovi" and a

whopping 27 centimeters above level zero!

But the chart also employs the "Not enough context"

technique, which is a very common thing to do in advertising. I mean

you wouldn't buy such an expensive ad if it weren't to tell some

carefully selected positive facts. In this case we are faced with a

timeseries with only four datapoints, covering a period of only four

months, June - September 2002. If we also take into account that in

Finland this is the time for everyones holidays, this data would

probably not be worth much in a more serious study. But as an

advertisement it's great.

But even more engineous than the scarce datapoints, is the fact

that we are not comparing apples to apples here. The slogan below the

chart says: "Guess the business is where the people is".

Now Oikotie is a service for buying and selling apartments, cars and

jobs. But the names of the other websites indicate, that they are

doing only one of the three: Etuovi (front door) is probably for

trading apartments, while Autotalli (garage) obviously is about cars

and Jobline... well you get the picture.

So

Oikotie may have the largest number of visitors alltogether. But what

if I want to buy a car? This chart doesn't seem to tell me what the

best place to do that is. While Oikotie on top probably is not the

worst of choices, we don't know whether it's a very good car trading

place, or whether most of the traffic there is actually about

apartments. Anyway, following the logic of the slogan, we could then

continue to conclude, that the second best place to sell your car is

the "front door" service, which obviously cannot be true.

So

Oikotie may have the largest number of visitors alltogether. But what

if I want to buy a car? This chart doesn't seem to tell me what the

best place to do that is. While Oikotie on top probably is not the

worst of choices, we don't know whether it's a very good car trading

place, or whether most of the traffic there is actually about

apartments. Anyway, following the logic of the slogan, we could then

continue to conclude, that the second best place to sell your car is

the "front door" service, which obviously cannot be true.

Thus this chart seems to actually mix in too much and too little

context at the same time! It's a definite thumbs up.

Optical illusions

So let's move to our final category, optical illusions. This is

the category of real magic, where our eyes start to see things that

don't exist at all.

Grayscale tricks

Our eyes are used to adapting to different levels of illumination.

We have adequate vision in an almost dark room and on the other hand

we have no problem adjusting to the brightest summer day. But this

capability can also be abused. Even when you know it's a fact, it's

difficult to admit that the four bars in the next picture are of the

same level of gray:

No matter how hard you try, it will always look as if the left bar

is darker than the right. This is because our eyes immediately adjust

to the background, and thus the same bar will look different against

different backgrounds.

So, how can we use this to create more deceitful charts? Actually,

within our topic, it's kind of difficult. The idea in itself is

simple, you could use an image in the background (like we did with

the beach and perspectives) where suitable areas would be darker or

lighter. But the problem is, to use this technique we would have to

encode our datavalues into grayscales. Now that might be possible if

we were drawing maps, but for financial data it would be rather

exotic:

The unorthodox encoding is likely to confuse the viewer so much,

that the trick itself is completely wasted. I myself have problems

understanding what I'm trying to do with that picture!

The unorthodox encoding is likely to confuse the viewer so much,

that the trick itself is completely wasted. I myself have problems

understanding what I'm trying to do with that picture!

But we can use this effect, known as crispening, in another kind

of trick. Consider Nokia's net profits once more. A basic bar chart,

but colored with grayscale gradients:

The shade of blue is added simbly because it looks good. But what

are we trying to do? The size of the bars is intact and the height of

the bars is also perceived correctly. But if I were to ask you to

point out the 50% height of both bars, the varying background will

add some challenge.

In our rational minds, we try to cut the bars in two halves, but

our eyes see something else. Our eyes easily fixate on the spots

where the gray shade of the bar equals the gray of the background.

Approximately these spots are:

If you previously felt that the right bar was mysteriously

strongly rising even though you knew

it's the shorter one, this was why. The spots where its' brightness

equals the background are higher than corresponding spots on the left

bar, giving a feeling that somehow - although it's still shorter - it

is rising very steeply. Another thing that adds to the effect is that

on both bars the spot his a bit higher on the right side than the

left, creating a feeling of an "upward trend". This comes

from the fact that the background lightens towards right, and the

bars are quite wide so the lighting is different on the left and

right sides.

And

how should we rate this? I must say I was expecting more from this.

Maybe it's just that I don't know how to do it correctly, but the

effect is not as powerful as I had hoped. But it's doing something

isn't it? Maybe I'm just imagining something that isn't there at all,

but I'm inclined to give it a very small thumbs up for good effort if

nothing else.

And

how should we rate this? I must say I was expecting more from this.

Maybe it's just that I don't know how to do it correctly, but the

effect is not as powerful as I had hoped. But it's doing something

isn't it? Maybe I'm just imagining something that isn't there at all,

but I'm inclined to give it a very small thumbs up for good effort if

nothing else.

Texture variations

Another effect where our eyes lie to us, is variations in texture.

An example would be the picture below:

The texture seems to become smaller (or thicker)

towards right. But there are two circular areas that differ from this

overall pattern. It seems like at the left there is an area with

quite a small texture while the area at the right has a larger

texture.

This is in fact a trick similar to the four identical

gray bars that seem to differ in brightness. The two circles in the

picture are completely identical. Their texture size just seems to be

different, because our eyes get confused when the background is not

constant.

So, could this effect be useful? Let's try with the net

profits from Nokia again:

Not impressed? Me neither. But the background seems to

have some kind of effect, if you compare it to what the plain bars

would have looked like:

In any case this is not exactly what we were heading

for anyway. If we compare with the original example, also the bars

should be texturized:

The

only real effect seems to be that the bars, especially the right one,

become hard to spot at all. Once you get a hold on them, they look

the same size as always.

The

only real effect seems to be that the bars, especially the right one,

become hard to spot at all. Once you get a hold on them, they look

the same size as always.

Ruling: We are not impressed. Even the grayscale tricks

were better than this.

9. Summary

What have we seen? A plethora of techniques that can be used to

distort reality in charts. Some were really astonishing, while others

failed miserably. Most techniques seem to be useful in either

emphasizing a positive trend that actually exists, or de-emphasizing

negative trends. It proved to be difficult to find techniques that

could actually make losses look like gains. Closest to actually

turning reality upside down, was chart 28 in the "Too much

context" category. There we needed one good looking curve under

which to hide all the negative ones:

The coolest effect in my opinion was the play with the moneybags

in different dimensions. It's still hard to accept that these charts

actually show the same thing:

But the prize for best overall effect goes to chart 4 in "Pick

your own scale". The jury especially praises the technique for

it's large flexibility and simplicity. It is very easy to implement,

fits a large range of different data and gives you flexibility in how

far ou want to go:

Finally the prize for "Greatest disappointment" is

awarded the "Optical illusions" category. Maybe it was my

inexcperience with such graphics that was the problem, but

nevertheless: we had great expectations and saw absolutely nothing:

1:

Edward R. Tufte, The visual display of quantitative information,

1983

2:

Helsingin Sanomat, "Oikotie" advertisement, 2002-11-12

3:

Colin Ware, Information visualization: perception for design, 2000

Table

1: Example data for lie factor graphics 4

Table

2: The Thumbs rating 6

Table

3: Net Sales for Nokia 2000-2001 6

Table

4: Net profits for Nokia 2000-2001 8

Table

5: Net profits for Sonera 1997 - 2001 (EURm) 13

Chart

1: Truthfull representation of data 4

Chart

2: False representation of data 5

Chart

3: Net Sales for Nokia 2000-2001 7

Chart

4: Net Sales for Nokia 2000-2001, with modified interval 7

Chart

5: Net profits for Nokia 2000-2001 8

Chart

6: Net profits for Nokia 2000-2001, with modified scale 8

Chart

7: Imaginative net profits for Nokia 2000-2002 9

Chart

8: Imaginative net profits for Nokia 2000-2002, with x-axis at

-1000 9

Chart

9: 5 year history of Nokias stock, linear scale 10

Chart

10: 5 year history of Nokias stock, log10 curve 10

Chart

11: Exchange rates for Nokia at NYSE on 2003-01-03 11

Chart

12: Exchange rates for Nokia at NYSE on 2002-01-02 12

Chart

13: Doing charts the Pravda way. Image originally appeared in the

Sovjet newspaper Pravda, taken from Tufte [1] 12

Chart

14: Net profits for Sonera 1997 - 2001 (EURm), with latest year

magnified 13

Chart

15: Soneras result drawn with moneybags as bars 14

Chart

16: Moneybags that grow in both directions 14

Chart

17: True 2-dimensional moneybags 14

Chart

18: 3-dimensional moneybags 14

Chart

19: Net profits for Sonera 1997 - 2001 (EURm), nice 3d effect 16

Chart

20: Net profits for Sonera 1997 - 2001 (EURm), another perspective

into same 3d effect 16

Chart

21: Net profits for Nokia 2001-2000, this time on a beach 17

Chart

22: Net profits for Nokia 2001-2000, now without the beach 17

Chart

23: Sonera moneybags one last time. Why does the trend look

positive? 18

Chart

24: Soneras result drawn with moneybags as bars, the original 18

Chart

25: Moneybags with their labels at the top of each bag 19

Chart

26: Net result for Sonera, 2001 19

Chart

27: 18 month history of Nokias stock 20

Chart

28: Financial statistics for Sonera 1997-2001 20

Chart

29: Helsingin Sanomat advertising for it's Oikotie website. Other

websites in the graph are "Etuovi", "Autotalli",

"Jobline", "Uranus".[2] 21

Chart

30: Four gray bars 22

Chart

31: Nokias net profits 2000-2001, values encoded in grayscale 22

Chart

32: Net profits for Nokia 2000-2001, gradient coloring 23

Chart

33: Gradient colored bars, spots of equal gray 23

Chart

34: Texture with a varying size 24

Chart

35: Net profits for Nokia 2000-2001, with background texture 24

Chart

36: Net profits for Nokia 2000-2001, without background texture 24

Chart

37: Net profits for Nokia 2000-2001, both background and bars

texturized 25

Chart

38: Turning losses into profits 25

Chart

39: Coolest trick 26

Chart

40: Best 26

Chart

41: Greatest disappointment 26

(2)

(2)

So

what about the lie factors? Technically there is nothing wrong in

what we have done. The numbers on the Y-axis are there, and the bars

are exactly the height of the values they are supposed to represent.

The chart comes out with a lie factor of one! When comparing the two

charts above, it is however obvious, that the second one is more

positive than the first one. Even though we can clearly see the

correct numbers to the left, our eyes tell us that the bar to the

right is 3,16 times higher than it's left companion. The

psychological lie factor will therefore be 3,16/0,03 = 105!

So

what about the lie factors? Technically there is nothing wrong in

what we have done. The numbers on the Y-axis are there, and the bars

are exactly the height of the values they are supposed to represent.

The chart comes out with a lie factor of one! When comparing the two

charts above, it is however obvious, that the second one is more

positive than the first one. Even though we can clearly see the

correct numbers to the left, our eyes tell us that the bar to the

right is 3,16 times higher than it's left companion. The

psychological lie factor will therefore be 3,16/0,03 = 105!

So

even if the chart is still technically correct, the cheating is too

obvious and what's even worse, the decline in profits is still

visible. This technique might be handy in some cases, but to cover up

a decline by almost 50% is too much to ask. We are forced to give a

negative verdict: thumbs down and caught for cheating!

So

even if the chart is still technically correct, the cheating is too

obvious and what's even worse, the decline in profits is still

visible. This technique might be handy in some cases, but to cover up

a decline by almost 50% is too much to ask. We are forced to give a

negative verdict: thumbs down and caught for cheating!

We

won't go into the discussion about the lie factors for this graph

(I'm trying to avoid the need to introduce the concept of a negative

lie factor), but it is obvious that it makes a difference whether

something points up or down. Whether we are still on the safe side

legally is a tough call. Now when we actually have negative values in

our data, it might be okay to have a negative axis. The judge might

let it pass, but I'll leave the handcuffs on just to be safe.

We

won't go into the discussion about the lie factors for this graph

(I'm trying to avoid the need to introduce the concept of a negative

lie factor), but it is obvious that it makes a difference whether

something points up or down. Whether we are still on the safe side

legally is a tough call. Now when we actually have negative values in

our data, it might be okay to have a negative axis. The judge might

let it pass, but I'll leave the handcuffs on just to be safe.

So

what about the handcuffs? Again we are not doing anything wrong,

altough you could argue that the log10 scale means a psychological

lie factor of 10. In any case the scientists do it all the time, so

it must not only be right, it's probably also intelligent and cool!

The only dishonesty is simply that people are used to seeing the

first chart. Thumps up and no handcuffs!

So

what about the handcuffs? Again we are not doing anything wrong,

altough you could argue that the log10 scale means a psychological

lie factor of 10. In any case the scientists do it all the time, so

it must not only be right, it's probably also intelligent and cool!

The only dishonesty is simply that people are used to seeing the

first chart. Thumps up and no handcuffs!

But

there is still a pitfall. This approach guarantees that all charts

will look like there was a storm at the stock exchange, even when the

curve is in fact very flat. A thumbs up to Yahoo for making sure that

every day on the stock market looks exciting. And no handcuffs for

the (very much so) valid excuse.

But

there is still a pitfall. This approach guarantees that all charts

will look like there was a storm at the stock exchange, even when the

curve is in fact very flat. A thumbs up to Yahoo for making sure that

every day on the stock market looks exciting. And no handcuffs for

the (very much so) valid excuse.

This

is the wet dream of Enron accountants! Just stretch the bar in both

directions until it's big enough. The slope in the bottom line

provides a hint for the viewer, that we have broken the scale at this

point and moved in for "a closer look". This is a standard

way of drawing in perspective, so the reader might even think this is

ok. But it's not. The lie factor for this graph is

This

is the wet dream of Enron accountants! Just stretch the bar in both

directions until it's big enough. The slope in the bottom line

provides a hint for the viewer, that we have broken the scale at this

point and moved in for "a closer look". This is a standard

way of drawing in perspective, so the reader might even think this is

ok. But it's not. The lie factor for this graph is

And

the judgement for this technique? There is a difference, but one bar

that is three times the height of everything else will stand out no

matter how you twist it. Having seen the moneybag tricks, we are not

impressed with this anymore. In a very tight situation this technique

could be used to give a psychological hint of what should be

considered high and what low. But we will give it a thumbs down. No

lying in this technique though, so there is no harm in using it if

you think it does something for you.

And

the judgement for this technique? There is a difference, but one bar

that is three times the height of everything else will stand out no

matter how you twist it. Having seen the moneybag tricks, we are not

impressed with this anymore. In a very tight situation this technique

could be used to give a psychological hint of what should be

considered high and what low. But we will give it a thumbs down. No

lying in this technique though, so there is no harm in using it if

you think it does something for you.

When

reading the numbers, you have to considerably lift your eyes to reach

the high number of 1506, leaving no doubt that it's way bigger than

the other ones. It's obvious from these three charts that the placing

of labels makes a difference (in fact it's the reason why I chose to

move the labels to the bottom in the 2d/3d experiments). If you want

to emphasize year 2000, use the last version. If you want to create a

feeling of a positive trend, use the first one.

When

reading the numbers, you have to considerably lift your eyes to reach

the high number of 1506, leaving no doubt that it's way bigger than

the other ones. It's obvious from these three charts that the placing

of labels makes a difference (in fact it's the reason why I chose to

move the labels to the bottom in the 2d/3d experiments). If you want

to emphasize year 2000, use the last version. If you want to create a

feeling of a positive trend, use the first one.

Bar

charts with only one bar is going too far, but used with the

appropriate amount of good taste and careful consideration, this

technique will be your friend in many tough situations. And best of

all, it's all 100% true.

Bar

charts with only one bar is going too far, but used with the

appropriate amount of good taste and careful consideration, this

technique will be your friend in many tough situations. And best of

all, it's all 100% true.

The

only downside with these techniques, is that if you make things too

unreadable, the reader might fall back to reading the actual numbers

in the financial statement again and we were trying to use graphics

to prevent them from doing that.

The

only downside with these techniques, is that if you make things too

unreadable, the reader might fall back to reading the actual numbers

in the financial statement again and we were trying to use graphics

to prevent them from doing that.

So

Oikotie may have the largest number of visitors alltogether. But what

if I want to buy a car? This chart doesn't seem to tell me what the

best place to do that is. While Oikotie on top probably is not the

worst of choices, we don't know whether it's a very good car trading

place, or whether most of the traffic there is actually about

apartments. Anyway, following the logic of the slogan, we could then

continue to conclude, that the second best place to sell your car is

the "front door" service, which obviously cannot be true.

So

Oikotie may have the largest number of visitors alltogether. But what

if I want to buy a car? This chart doesn't seem to tell me what the

best place to do that is. While Oikotie on top probably is not the

worst of choices, we don't know whether it's a very good car trading

place, or whether most of the traffic there is actually about

apartments. Anyway, following the logic of the slogan, we could then

continue to conclude, that the second best place to sell your car is

the "front door" service, which obviously cannot be true.

The

only real effect seems to be that the bars, especially the right one,

become hard to spot at all. Once you get a hold on them, they look

the same size as always.

The

only real effect seems to be that the bars, especially the right one,

become hard to spot at all. Once you get a hold on them, they look

the same size as always.